-40%

2021 TKT PAYROLL SOFTWARE Small Business DOWNLOAD NOW

$ 8.94

- Description

- Size Guide

Description

Check out our other eBay payroll listingsPlease visit

www.tktenterprises

1

.com

on the internet to download this software

Ebay requires that digital download software be listed in the Classified Ad format.

This format does not enable buyers and sellers to transact online through eBay nor is eBay Feedback available. We own the TKT Payroll intellectual property rights. No one else is licensed or authorized to sell TKT Payroll.

2021 Federal and St

ate Tax Tables!

FREE

Email technical support!

TOTAL PRICE - .95.

GREAT VALUE!

TKT Payroll Version 16.1.0

is loaded with

2021 Federal and

State tax tables.

.

Stand Alone Program.

Why pay subscription or online service fees?

Take charge of your payroll !

QUICK, EASY Installation.

TKT Payroll is a cost-effective solution that will save you time and money.

Manage your own payroll. No on-line payroll service required. Start using TKT Payroll at any time of the year - just enter year-to-date balances for each employee.

Requirements

OS: Windows 10, 8.1, 7, Vista

Withholding Tax Calculations

Software comes loaded with

federal, state, and DC tax tables

.

Users can purchase download updates for any future tax changes

.

Calculates deduction for City (includes New York City tax table) or County tax.

Optional extra federal & state tax deductions per employee supported.

Reports

Use an inkjet or laser printer to print reports.

Print Form 941.

Laser-printed W-2 Copy A and W-3 forms APPROVED by Social Security Administration. Print all W-2's on plain paper with your laser printer. Choice of printing on pre-printed W-2 forms using an inkjet or laser printer.

Supports EFW2 electronic filing of Forms W-2 to the Social Security Administration.

Print checks for Form 1099-NEC nonemployees, and print year-to-date information to Forms 1096 and 1099-NEC on plain paper with your laser printer. Choice of printing on pre-printed 1099-NEC forms using an inkjet or laser printer.

Print PAYROLL CHECKS using any checks that are compatible with DELUXE Laser Mid Multipurpose Check DLM102 or classic style QuickBooks Laser Top Multipurpose Check DLT104.

Choice of printing only pay stubs with current and year-to-date totals. No direct deposit feature.

Print California Quarterly DE 9 and DE 9C with data.

Print New York Quarterly NYS-45 and NYS-45-ATT, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return with data.

For all other states (except CA and NY), print the TKT Payroll quarterly payroll summary report which can be used to manually prepare the State quarterly withholding tax report.

Print current, monthly, quarterly summary reports.

Print Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return) for signature.

Print state unemployment information reports.

Other Features

CORRECTIONS can be made to any prior pay period. All subsequent year-to-date pay period totals will automatically be adjusted.

AFTER THE FACT PAYROLL entries for accountants are supported. Automatically calculates Social Security and Medicare.

100 employees maximum per company. All employee record information on one screen.

Number of companies limited only by hard disk drive space.

Five tax pay cycles (weekly, bi-weekly, semi-monthly, monthly, quarterly).

Four hourly rates plus overtime per pay period per employee.

Track Paid Time Off for Vacation and Sick pay. Supports sick pay earned per hours worked.

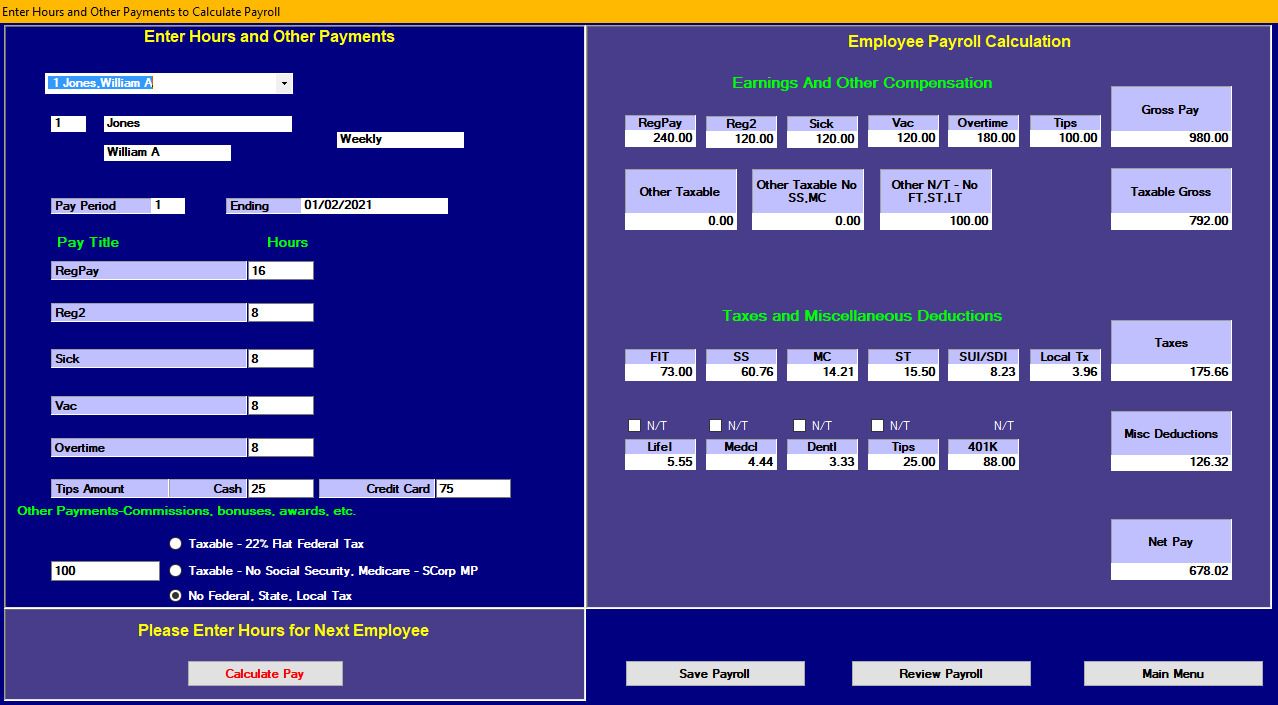

Enter HOURS, Cash TIPS, Credit Card TIPS, and Other Payments for each employee on the "Enter Hours to Calculate Pay" screen (shown above) and click the "Calculate Pay" button to automatically calculate and display taxable and non-taxable gross, taxes, misc. deductions, and net pay.

State Disability Insurance deduction.

Five miscellaneous deductions ( one as non-taxable for 401(k), four can be named and designated as taxable or non-taxable).

Refund Policy Details

There are no refunds on Digital Downloads.